Analysis of aluminum industry resumption and aluminum price trend under the influence of the epidemic

SMM News: On the first day of market opening in 2020, due to the negative impact of the epidemic, Shanghai Aluminum's main contract in 2003 expanded by the mood-driven shock interval, with a low of 13,510 yuan / ton, a new low of nearly a year. Subsequently, the shock continued, but with the large inventory accumulation and the delay in the resumption of business, what is the demand for aluminum? What is the trend of aluminum prices? On February 7th, SMM held a WeChat group live broadcast event. SMM analysts conducted various investigations on the industry chain from the cost-side alumina and electrolytic aluminum inventory to aluminum processing and downstream companies' resumption time. Corresponding analysis, the minutes of this meeting are collated and shared with you.

Alumina

▍The epidemic seriously affects the alumina plant's raw materials entering the plant and the delivery of finished products

1. The supply of raw materials mainly affects the main raw materials of ore, caustic soda, ash and coal.

1) In terms of ore, domestic mines are hindered by steam transportation and civilian mining has not yet started. Therefore, some inland alumina plants in Henan and Shanxi, especially those without their own mines and those mainly producing high temperature lines, cannot The timely replenishment of the stockpiles resulted in a relatively low level of domestic ore stocks; imported ore actually has less pressure in arriving at the port. At present, ports can normally unload the port without ensuring crew changes, and Guinea ’s rainy season ends with crude oil to suppress shipping Fees have fallen and arrivals are expected to increase. However, due to the shortage of short-shipment transportation, the resistance to sparse port is relatively large, which currently affects the level of imported ore stocks of individual alumina plants in Inner Mongolia and Shanxi.

2) In terms of caustic soda and ash, we understand that the difficulty in shipping the caustic soda plant has led to inefficient inter-provincial procurement and transportation of the alumina plant in Henan and Shanxi, affecting their inventory levels; for some alumina plants in Shandong, the impact is small because It is near the main place of production of caustic soda, and the transportation in the city is basically normal. In addition, some Henan enterprises had to suspend the plan to purchase lime from Hubei, and the inventory was tight.

3) In terms of coal, most of the coal mines in Shanxi and Shaanxi will resume production after February 9th, and there will be greater pressure on coal transportation in the port. We understand that there are currently 3 large alumina companies in Shandong and Shanxi due to the shortage of coal supply. Suspend or plan to suspend some roasting capacity.

Second, the epidemic situation also has a relatively serious serious impact on the alumina shipment. At present, railway shipments are basically normal, but the rate is far less than that of automobile shipments.

Auto transport has been greatly affected. There are two main points. First, multi-ship auto transport shipments need to be reported in advance, and the local leadership team will uniformly plan the dispatch plan. Second, there are fewer available vehicles and on-site drivers. Proactive price increase but logistics difficult to find. Therefore, the low shipping efficiency has caused some companies to increase their own inventory compared to before the holiday.

In terms of different regions, the alumina plants in the northern region have been severely affected by the current epidemic situation. At present, there are already alumina plants in Shanxi and Shandong that have reduced their production due to tight raw material inventory. 10,000 tons, the extension of the Spring Festival holiday may lead to a further increase in the risk of alumina production reduction. The production capacity of alumina in Southwest China is basically the same as that at the end of January, and the impact of the epidemic is relatively small. The stock levels of various raw materials can ensure the current production. Some Chongqing and Guizhou enterprises have slow delivery of alumina, so the finished product inventory has increased compared with the previous period. SMM estimates that in February (29 days) metallurgical grade alumina production will be 5.118 million tons, and the average daily output of metallurgical grade will drop to 176,000 tons.

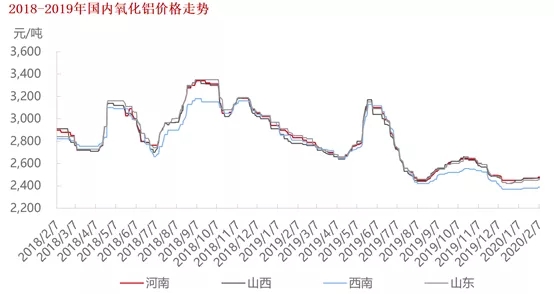

▍Alumina price forecast

According to the calculation of production volume and net import volume, the current domestic alumina supply performance is slightly excessive, and the actual production reduction scale of domestic alumina plants is not large. Therefore, the buyers and sellers are hesitant to quote, and the degree of influence on subsequent logistics remains uncertain.

At the beginning of the week, spot transactions were mainly based on demand and the scale was small, but according to SMM, due to the uneven supply situation in the current domestic alumina market, the supply side is tight but the demand side is tight. Therefore, SMM believes that in the short term, it is affected by logistics factors. Under the situation of rising purchase demand from some electrolytic aluminum plants, the spot price of alumina may rebound in the past two weeks. The rebound height and sustainability need to pay attention to changes in logistics policies and reduce alumina production. The impact of scale and inventory levels of electrolytic aluminum plants.

Electrolytic aluminum

As far as production is concerned, as far as we know, although some electrolytic aluminum companies are currently experiencing tight raw material inventory, they can maintain normal production after actively increasing procurement costs, asking for help from the society, and government scheduling, and the new production rate has not been affected by the epidemic The impact has slowed significantly. However, there is still a shortage of coal in electrolytic aluminum plants, so it is necessary to continue to pay attention to the impact of transportation.

According to some electrolytic aluminum companies in Xinjiang and Inner Mongolia, we have stated that after the holiday is extended, the original aluminum water consumption ratio will continue to remain low during the holiday and the amount of ingot will increase. This will cause the overall supply of aluminum ingot to remain high for a period of time. The amount of aluminum ingots at the consumer sites will continue to increase, and the inventory level of the overall consumer sites is expected to continue to rise.

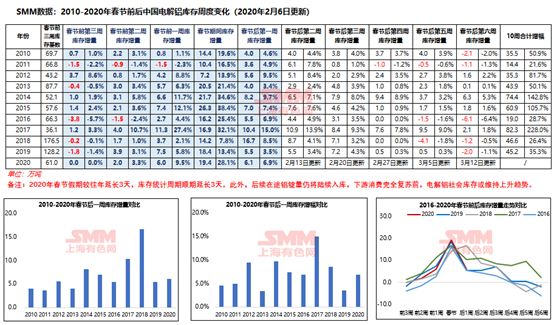

▍In stock

As of February 6, SMM's statistics on the domestic electrolytic aluminum social inventory reached 945,000 tons, an increase of 255,000 tons from the previous Spring Festival, an increase of 36.96%. In addition to the impact of the epidemic, which extends the Spring Festival holiday by about 3 days, the arrival of aluminum ingots during the Spring Festival holiday this year is the highest year-on-year increase in the past five years. About 200,000 to 1.2 million tons.

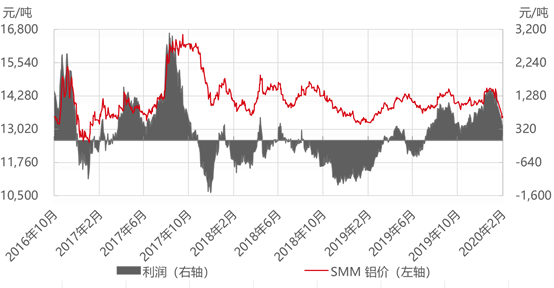

At present, the raw material inventory of electrolytic aluminum plants is lower than before the holiday, and the procurement and related transportation costs are higher than before the holiday. At the same time, the downstream processing enterprises of the aluminum factory have light demand. Under the pressure of both ends, aluminum enterprises are under greater financial pressure. As of Friday, due to the negative price of aluminum and the slight increase in the prices of raw materials such as alumina and prebaked anodes, SMM has calculated that the instant earnings of domestic electrolytic aluminum have fluctuated at a high level of around 1,000 yuan before the correction, shrinking to 394.88 yuan / ton.

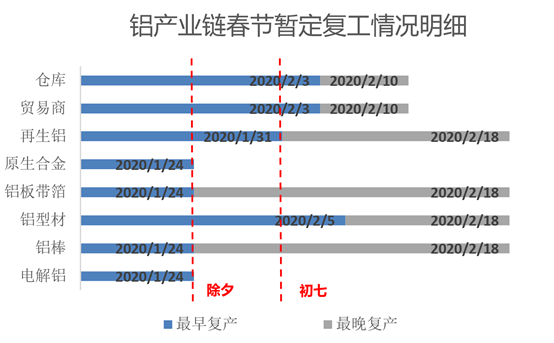

Aluminum: The outbreak has a more direct impact on downstream consumption. First of all, from the perspective of time, it is mainly reflected in the long-term and short-term aspects. In the short-term, the epidemic situation directly led to the extended vacation of downstream aluminum processing enterprises.

According to SMM surveys, in terms of aluminum processing, Henan aluminum plate and foil companies, Guangdong aluminum profile companies, and aluminum processing companies in Jiangsu and Zhejiang extended the Spring Festival holiday by at least 7-10 days, and some provinces extended the holiday time by more than 14 days. After 3 days, the procurement of spot aluminum ingots by downstream processing companies was weak, and overall electrolytic aluminum consumption was postponed.

In the long run, the impact of the epidemic on the end market will be indirectly transmitted to the orders of electrolytic aluminum processing enterprises. These areas involve real estate, automobiles, electricity, home appliances and other aluminum-intensive sectors. Within or will be transmitted to the consumption of primary aluminum.

▍From the perspective of aluminum processing product segmentation:

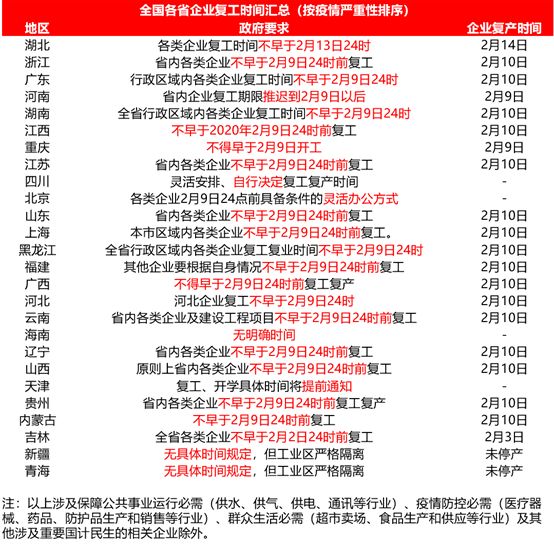

Aluminum profiles: Most domestic profile companies are currently in shutdown, but there are still a small number of Chinese New Year holidays that continue to produce. According to the SMM survey, starting from next Monday (February 10), profile companies will gradually rework and resume production, but there are three problems: 1. Regional policy issues, and the epidemic situation in different provinces and cities varies, which makes There are differences in the government's requirements for the resumption of business, and some regional profile companies may be pushed to mid-to-late. The specific time must wait for the local government's notification; 2. Staff issues, especially profile companies with a large proportion of foreign employees, are facing return trips and subsequent The quarantine and observation period will be very tedious, and the company will not be able to achieve the ideal production status after starting the project. 3, logistics problems, some areas with severe epidemics, transportation is almost stagnant, vehicles and people are limited, including aluminum ingots / aluminum bars and other raw materials and finished products Access is affected.

In addition, in terms of terminals, real estate and other building material demand areas are most affected. Construction site construction projects in some areas are not allowed throughout February, while photovoltaic and other industrial materials areas are relatively less affected. In terms of raw materials, aluminum rod companies still maintain a certain level of operating rate during the holidays. Strict isolation measures are implemented in the industrial areas, and the impact of the epidemic is limited. The problems they face are similar to those of profile companies, that is, the return trip of foreign employees and the outward product Transport dilemma. In general, in the short term, the epidemic will continue to affect terminal demand, the supply and demand of intermediate processing companies will have difficulties at both ends, and the price of raw materials will also be under certain pressure.

▍So from the perspective of the market segment, first of all, the strip foil: